Increasing awareness regarding softening the hard water along with regulatory inclination toward reducing water pollution in industrial and household sectors is expected favorably impact water treatment chemicals and technology market. Growing manufacturing sector in India, China, and the Middle East with the regulatory support to promote investments at domestic level has triggered the use of water treatment chemicals in industrial applications.

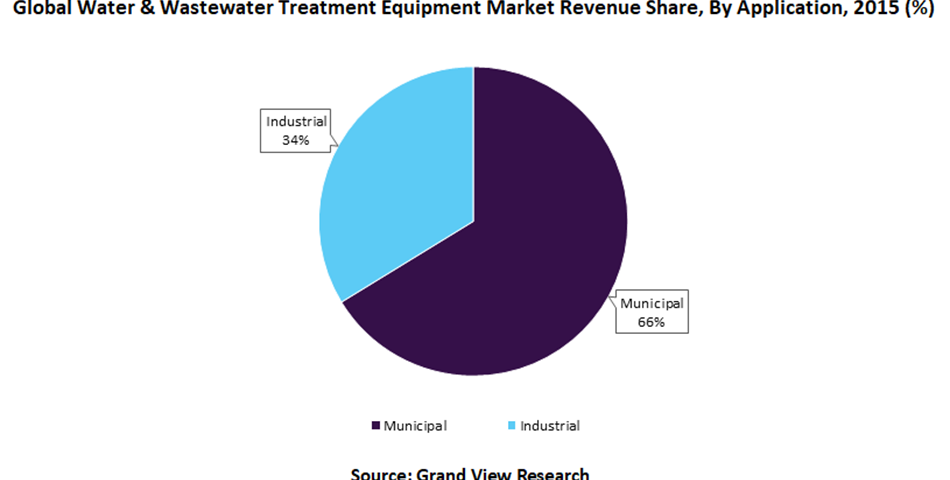

The market is expected to witness substantial growth owing to rising demand for freshwater across the globe coupled with increasing global population. Depleting freshwater reserves with increasing requirement from commercial and industrial sector is expected to drive market growth. Environmental concerns and increasing efforts to modernize the municipal water treatment facilities owing to stringent wastewater management and municipal water standards are expected to propel the market growth. Furthermore, rising pressure from regulatory framework on industrial sectors to use water treatment processes on industrial wastewater is anticipated to augment market growth. Increasing access to safe drinking water and improved sanitation facilities to people in developing regions including Africa and Asia Pacific is expected to augment the growth of global water treatment chemicals market. According to a report by Grand View Research, Inc., in 2015, the global water treatment chemicals and technology market was estimated at USD133.73 billion and is projected to grow over USD175.77 billion by 2025. Growing importance of flocculants for effluent treatment as surfactants in the mining industry is likely to have a positive impact over the forecast period. Technological advancements pertaining to the development of bio-based chemicals such as guar gum and gelatin in light of rising concerns regarding carbon emissions associated with the production and usage of synthetic products are expected to open new avenues for market development.

Pumping systems accounted for the highest contribution in the global revenue and the segment is projected to reach a market value of USD 119.15 billion by 2022. The segment growth is expected to be driven by the automation systems in the near future. On the chemical front, corrosion and scale inhibitors are expected to drive the market growth over the forecast period, contributing to a total revenue of USD 9.98 billion by 2022.

Findings form the study suggest that North America occupied the largest market share in 2015 and it is expected hold a share of 28.5 percent by 2022, losing some of its share mainly to Asia Pacific. Asia Pacific is estimated to reach a market valuation of USD 55.19 billion by 2022. North America was the largest market in 2015 on account of high awareness regarding water treatment in household and industrial sectors of the U.S. and Canada. The emergence of Mexico as an automotive hub in the light of rising automotive sales at domestic level is expected to increase the industrial output and, thus, likely to open new market avenues for water treatment.

Robust manufacturing base of chemicals, pharmaceuticals, and automotive industries in European countries such as Germany, France, and Italy is expected to increase the application of wastewater treatment in the near future. However, high utility cost in the U.S. and European countries, particularly Germany, has forced the major industrial companies to shift their facilities to Asia Pacific as the region is characterized by low manufacturing expenditure. Asia Pacific is expected to become the largest market by 2022 as a result of the infrastructural development of China and India and the emergence of Southeastern countries as manufacturing hubs of naturally-derived chemicals.

Pumping systems is expected to remain the largest product segment over the next seven years on account of increasing application of pumps in effluent treatment in manufacturing industry. Technological advancements for inducing good flow characteristics have increased the expenditure on the development of new valves and automation systems for water treatment, which is likely to have a positive impact on the market.

Separation membranes segment is expected to witness the fastest growth on account of their increasing application as a filtration medium in pharmaceuticals and chemical industries. Increasing expenditure for the development of microfiltration and ultra-filtration is expected to have a positive impact on the market in the near future.

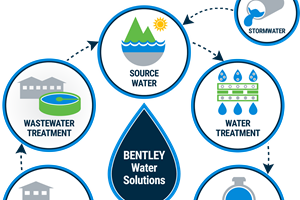

Water treatment market value chain comprises the conglomeration of chemicals, pumping systems, and membrane separation manufacturers. Pumping system manufacturers source their raw materials from gears, metals, blades, engine parts, and electrical system manufacturers. ITT, KSB, Flowserve are some of the manufacturers of water treatment pumping systems engaged in the production of pumps, valves, and automation systems. These manufacturers supply their product forms through pump suppliers, which include Fisher Process Industries, MacEwans, and All Pumps.

The Safe Drinking Water Act and its amendments establish the basic framework for protecting the drinking water used by public water systems in the United States. This law states the requirements for ensuring the safety of the nation's public drinking water supplies. Public drinking water supplies include water systems, which regularly serve 25 or more people per day or which have at least 15 service connections.

Europe has the most stringent laws regarding water treatment. The water policy of the European Union (EU) is primarily driven by three directives. The Urban Waste Water Directive takes care of the discharge of municipal and some industrial wastewaters. The Drinking Water Directive is concerned about potable water quality and the Water Framework Directive takes care of the water resources management. In limiting contaminant levels, the directive defines the precautionary principle. For instance, EU has directed to limit contaminant levels for pesticides to 20 times lower than the WHO drinking water guidelines, as the EU directive mainly aims at protecting the environment along with human health.

Prices of amines, polymers, and phosphonates have witnessed similar growth. Energy prices also impact the cost of production and transportation of all manufactured goods. Also, water-related technologies are also expensive to implement and require in-depth technical knowledge along with skilled plant operators. In addition, the technologies require steady energy supply, chemicals, and specific equipment, which may not always be readily available. Sustainable solutions are expensive in nature, and therefore not easily available to and affordable for a majority of the market players.

The global market for pumps was moderately concentrated with market players occupying similar market shares ranging from 3 percent to 6 percent. Grundfos and Flowserve were the leading producers of pumps occupying market shares ranging from 5 percent to 5.2 percent. Ebara had a significant market presence and occupied 4.5 percent of the market share, with nearly 25 percent of its total sales coming from outside of Japan.

Praj Bhilare

Specialist in Market Research, Business Intelligence, and Client Acquisition

Grand View Research