Increasing demand for water in domestic & industrial applications as a result of the growing world population is a major market driver for the market.

The global water & wastewater treatment equipment industry has gained a significant momentum over the past decade. The industry has witnessed an extensive transformation from a niche to a dynamic global market and has exhibited every indication of its significance over the past few years. Rising demand for potable water, mainly owing to rapid population growth coupled with technological developments, rapid urbanization, and robust infrastructural development, have amplified the demand for this equipment in the emerging economies.

According to a report conducted by Grand View Research, Inc., the global water & wastewater treatment equipment market was valued at USD 50.65 billion in 2015 and is projected to reach over USD 103.41 billion by 2025. Emerging concerns such as increasing environmental footprints and wastewater elimination in water ecological units are expected to boost the adoption of effective unit structures over the forecast period.

Stringent government policies are expected to play an important role in monitoring the generation of wastewater and promoting the processing & recycling of the same. In the past, the European Union (EU), an important legislative authority globally, not only restructured its governing policies but also introduced new ones to streamline the guidelines and make them more efficient. For instance, in 2012, the EU presented a proposal on municipal application in the region.

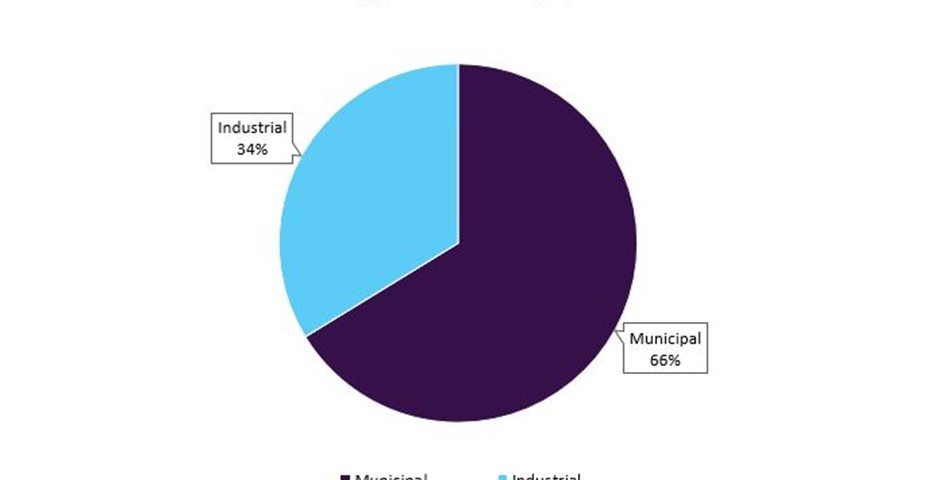

As per the findings of the GVR report, municipal and industrial are the key application segments for this equipment. Municipal application accounts for the largest market revenue share of around 66.3%. In terms of revenue, municipal application is expected to be valued at USD 68.33 billion over the forecast period.

Industrial application is projected to emerge as the fastest-growing segment over the forecast period, especially in Asia Pacific, owing to rising industrialization combined with a sustained growth in water demand for power generation, paper & pulp manufacturing, oil & gas, and mining in developing countries.

On the basis of product, water and wastewater market has been segmented into disinfection, membrane separation, sludge, and biological among other processes. Filtration & purification includes chemical methods such as demineralization, fluorination, and deionization. Membrane is expected to emerge as the fastest-growing product segment owing to the superior efficiency of the product. Furthermore, this segment is estimated to progress at a CAGR of 8.0% over the forecast period, in terms of revenue, owing to the rising adoption of membranes over conventional equipment systems. In 2015, sludge equipment segment was the second-largest in terms of revenue generation in the overall industry. Sludge equipment is used in the treatment of both industrial and municipal waste slime.

On the basis of technology, the market has been categorized into three main segments, namely primary treatment, secondary treatment, and tertiary treatment. Tertiary treatment segment holds the largest global market share of over 42.3% and is projected to ascend at a CAGR of 7.5% over the forecast period.

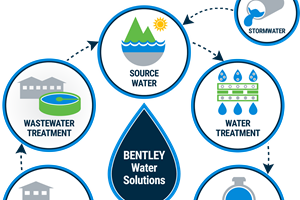

The value chain of water & wastewater treatment industry includes companies or a network of stakeholders that are involved in the process of eliminating contaminants present in the water through mechanical or chemical procedures in order to make it more compatible or acceptable for humans. The different types of companies in the industry value chain have been described below.

- Companies such as Aquatech, Best Water, Calgon, and Danaher are engaged in the provision of water & wastewater treatment equipment that also render services to their players operating water treatment facilities

- Companies such as Ashland, Buckman Laboratories, GE Water, and Suez Environnement have integrated their operations from equipment provision to water treatment facilities

- After the purification process, the water is transferred to the end users: Municipal or Industrial.

The U.S. and Canada are key consumers of water & wastewater treatment equipment. Over the next decade, rising gas exploration activities along with a significant demand for industrial aquatic recycling is projected to boost the industry growth. Ecolab, Inc. and GE Water & Process Technologies are major players that have a dominant presence in the market.

In 2015, Asia Pacific occupied a major share of 43.2% in wastewater equipment industry in terms of revenue. Countries including India, Singapore, and China, which are among the major consumers of the equipment, are expected to influence the industry expansion. Population explosion, technological developments, rapid urbanization, and growth in infrastructure are the major driving factors that support the strong growth in the region.

Central & South America market is projected to ascend at a CAGR of 9.3% CAGR by the end of 2025. Favorable regulatory support in the region is expected to promote the growth of wastewater treatment equipment industry at the domestic level. A substantial adoption of equipment systems, particularly in the public sector, along with rising concerns regarding poor hygiene and fecal sludge disposal in the region are the major factors boosting the industry growth.

Europe accounted for 27.4% of the global market share in 2015 and is anticipated to witness a sustained growth at a CAGR of 6.0% by the end of 2025. GE Water & Process Technologies, Culligan International Company, Veolia Environnement S.A., Suez Environnement S.A., Aquatech International Corporation, and Ecolab, Inc. are some key players in the regional market.

Water & wastewater treatment industry is very competitive in nature as the product offerings are quite homogenous. This industry is heavily dependent on raw material suppliers and is majorly influenced by the raw material pricing. The market is characterized by a large number of players involved in capacity expansions as well as mergers & acquisitions in a bid to increase their market share. The companies are also involved in price reductions and offering discounts to claim the water & wastewater treatment projects across the globe. Industrial rivalry is likely to remain high over the forecast period owing to brand loyalty and accelerated industrial growth. The companies are focusing on optimum business growth by implementing various strategies.

Growing industrialization coupled with the increase in demand for energy is expected to lead to a high growth of oil & gas sector. This, in turn, is projected to propel the demand for water & wastewater treatment plants. High demand for water and wastewater treatment in various countries including China, India, Brazil, South Africa, the U.S., and Australia is anticipated to drive the market over the next nine years.