Magnetic flowmeters are running neck and neck with Coriolis meters as a revenue leader in the global flowmeter market, according to a new study from Flow Research.

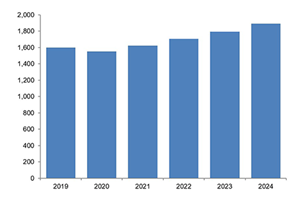

Magnetic flowmeters are running neck and neck with Coriolis meters as a revenue leader in the global flowmeter market, according to a new study from Flow Research, The World Market for Magnetic Flowmeters, 7th Edition. The photo above shows the worldwide market for magnetic flowmeters from 2019 to 2024 in millions of dollars.

The new study found that the worldwide magmeter market totaled $1.6 billion in 2019, slightly ahead of the Coriolis market. In 2020, the magmeter market dropped slightly below the Coriolis market (to $1.5 billion) and continues to hover only slightly below that market, growing steadily, though less rapidly than Coriolis, ultrasonic, and vortex flowmeters.

Magmeters are among the most widely used types of meters for measuring the flow of water and other liquids. They are widely used in the water & wastewater and chemical industries, as well as in food & beverage. Since less than eight percent of the magmeter market is in oil & gas applications, magmeters proved more resilient than other flowmeters during the height of the pandemic and the slump in oil prices.

Now magmeters are also benefitting as the market recovers and the oil & gas industry surges. Even though they don’t measure hydrocarbons, magmeters are used for fracking applications, including measuring water injected into oil and gas wells and water flowing from them for capture, disposal or recycling.

Magmeters are also increasingly in demand to more closely monitor water supplies and usage as water shortages and climate change highlight water as a precious commodity. In fact, thanks to new industry group standards that include using magmeters for water utility measurement, magmeters are now displacing positive displacement and turbine meters in some residential and industrial applications.

Another major growth factor for magnetic flowmeters is their large installed base worldwide. Magnetic flowmeters were first introduced for commercial use in 1952, well before other new technology flowmeters, including Coriolis (1977), ultrasonic (1963), and vortex (1969). Magnetic flowmeters have had more time to penetrate the important large markets in Europe, North America, and Asia and perpetuate an advantage with users who tend to replace like with like.

Fundamental advantages

Magnetic flowmeters have many intrinsic advantages that help make them a revenue leader. They are non-intrusive, with no moving parts, provide a highly stable measurement, and do not cause pressure drop. They are also highly accurate and can be used for custody transfer applications. Magmeters are available in a wide range of sizes, from less than ⅛ inch to over 100 inches, with insertion designs that can measure liquids in large line sizes at lower costs than inline models.

Liners allow magmeters to adapt to a wide range of liquids and applications, from very dirty liquids and slurries in the pulp & paper and wastewater industries to very clean hygienic and sanitary liquids in the food & beverage and pharmaceutical industries. The increasing availability of many types of liners is driving growth.

Technology improvements are also helping magmeters expand their range of applications. Although magmeters will probably never measure nonconductive liquids, suppliers have succeeded in reducing the amount of conductivity required to measure flow, in part by creating a stronger signal through boosting the amount of power used to excite the magnetic coils.

Other improvements gaining acceptance include two-wire meters that use the loop-power supply to reduce wiring and installation costs; battery-powered and wireless models; and long-lasting lithium batteries.

According to Dr. Yoder: “Now is the time for magnetic flowmeters to shine. With climate change and diminishing water supplies, the need to measure water is increasing around the world. The need for more clean water and wastewater treatment is growing with the population. Magmeters are one of the few flowmeter types that can effectively measure wastewater. Multiple liner types make them useful on a wide variety of other liquids. And suppliers continue to bring out technological improvements that make them more versatile and more competitive with other flowmeter types.”

The World Market for Magnetic Flowmeters, 7th Edition determines the regional and worldwide market size and market shares of the leading suppliers determines the regional and worldwide market size in 2019 and 2020 and forecasts market growth through 2024. The study reveals the effect of the pandemic on the magmeter market as well as the rebound that occurred in 2021 and that continues in 2022. It also analyzes products from all of the primary magmeter suppliers, profiles the significant worldwide suppliers, identifies the top industries and applications, and proposes market and product strategies.

About Flow Research

Flow Research is the only independent market research company whose primary mission is to research flowmeter and other instrumentation products and markets worldwide. Flow Research, founded in 1998 in Wakefield, Massachusetts, specializes in flow measurement devices, and conducts market research studies in a wide variety of instrumentation areas. These studies are developed through interviews with suppliers, distributors and end users. Topics include all of the flowmeter technologies–both new and conventional–as well as temperature sensors, temperature transmitters, level products, and pressure transmitters. The company has a special focus on the energy industries, especially on oil and gas production and measurement.